Exposing the Lies of agora.cash

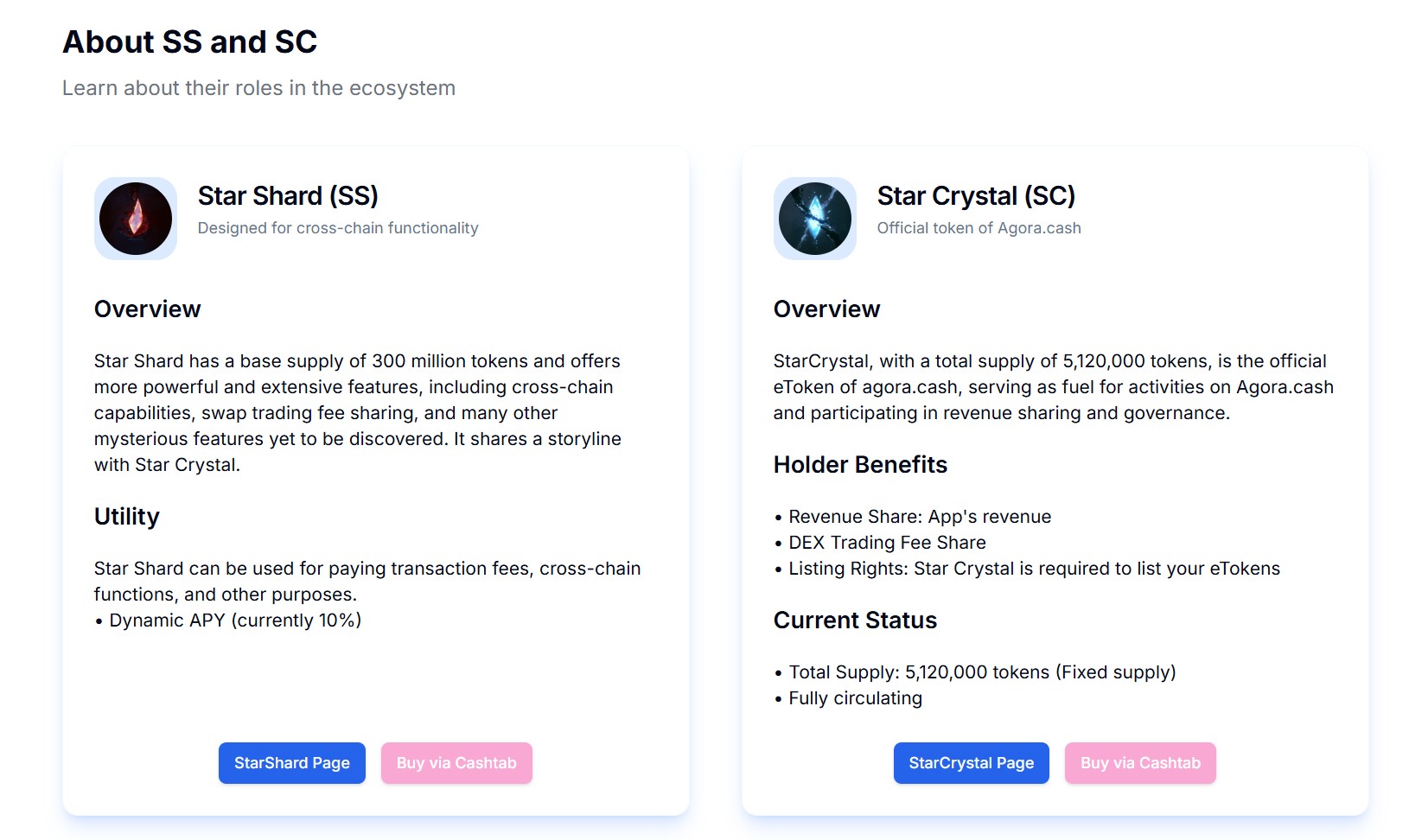

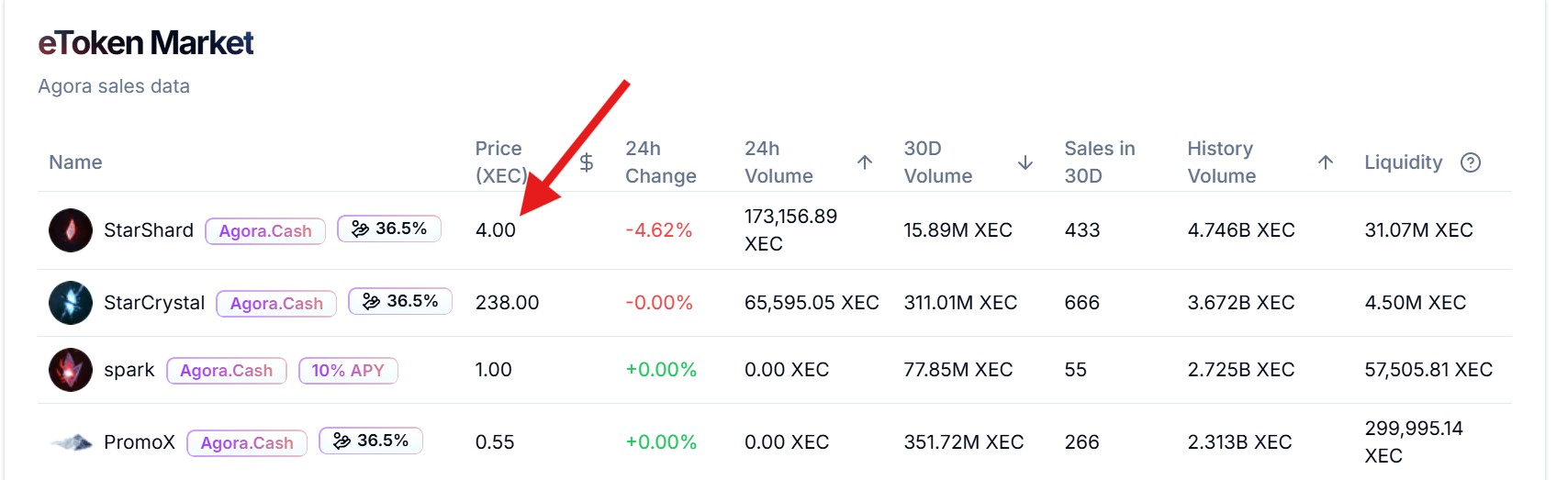

Agora.cash has issued four tokens, two of which have already defaulted.

Star Crystal (SC): The promised yield suddenly stopped without any explanation. This is a default.

Star Shard (SS): This already constitutes fraud:

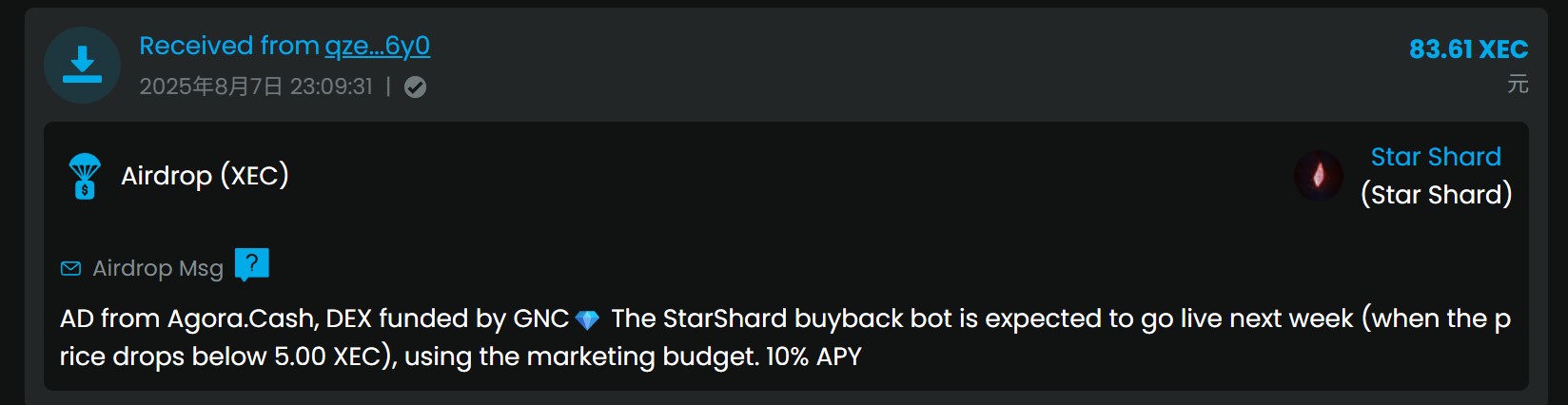

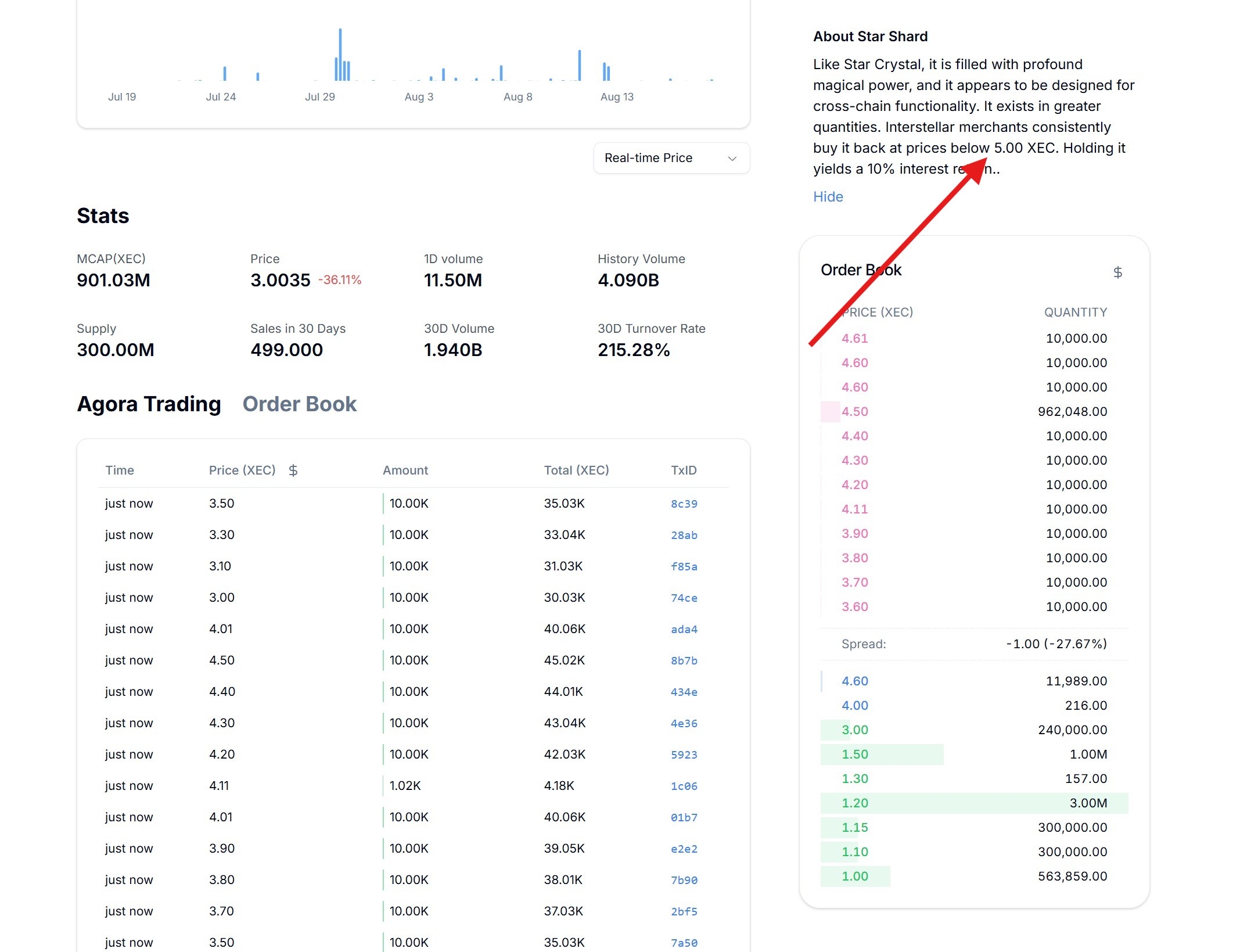

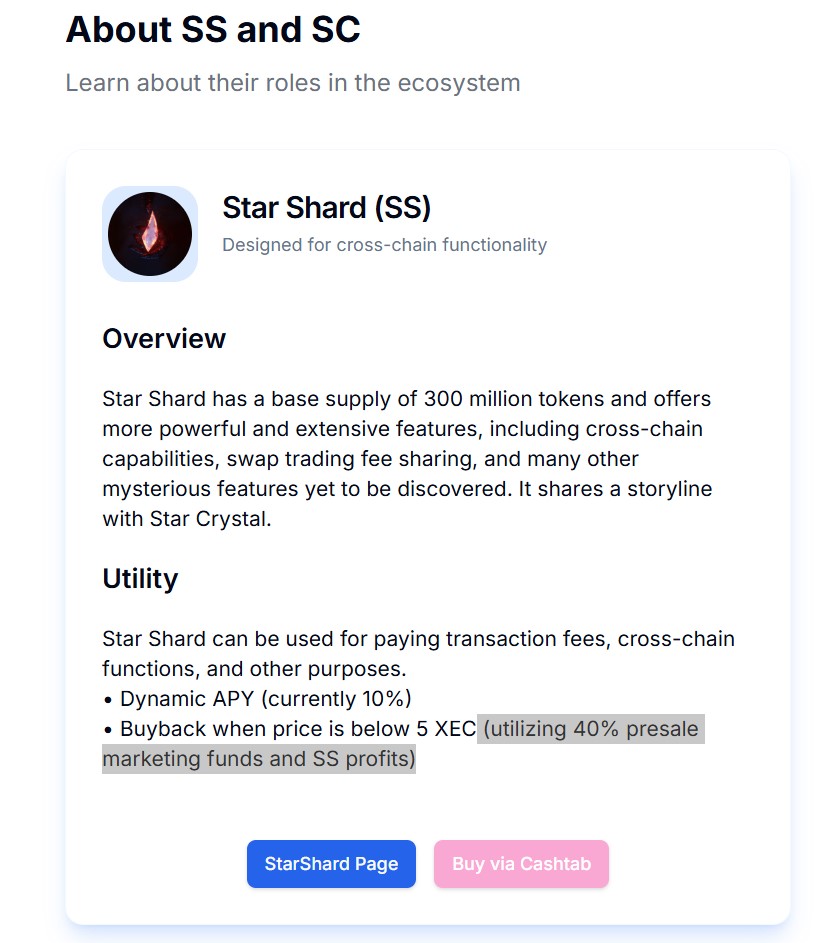

1. The lie concerning Star Shard (SS)’s promise to buy back the token if the price fell below 5 XEC.

I believe many people, myself included, purchased the token specifically because of this promise of a buyback below 5 XEC.

We cannot say agora.cash never executed the buyback, but it was only executed for a brief period. Furthermore, large transactions appear to be wash trading (self-selling and self-buying).

Later, agora.cash quietly changed the terms by adding new limitations, but they still failed to deliver on the promise.

Now, they have simply deleted it, pretending it never happened.

2. Token Dilution (Unauthorized Issuance)

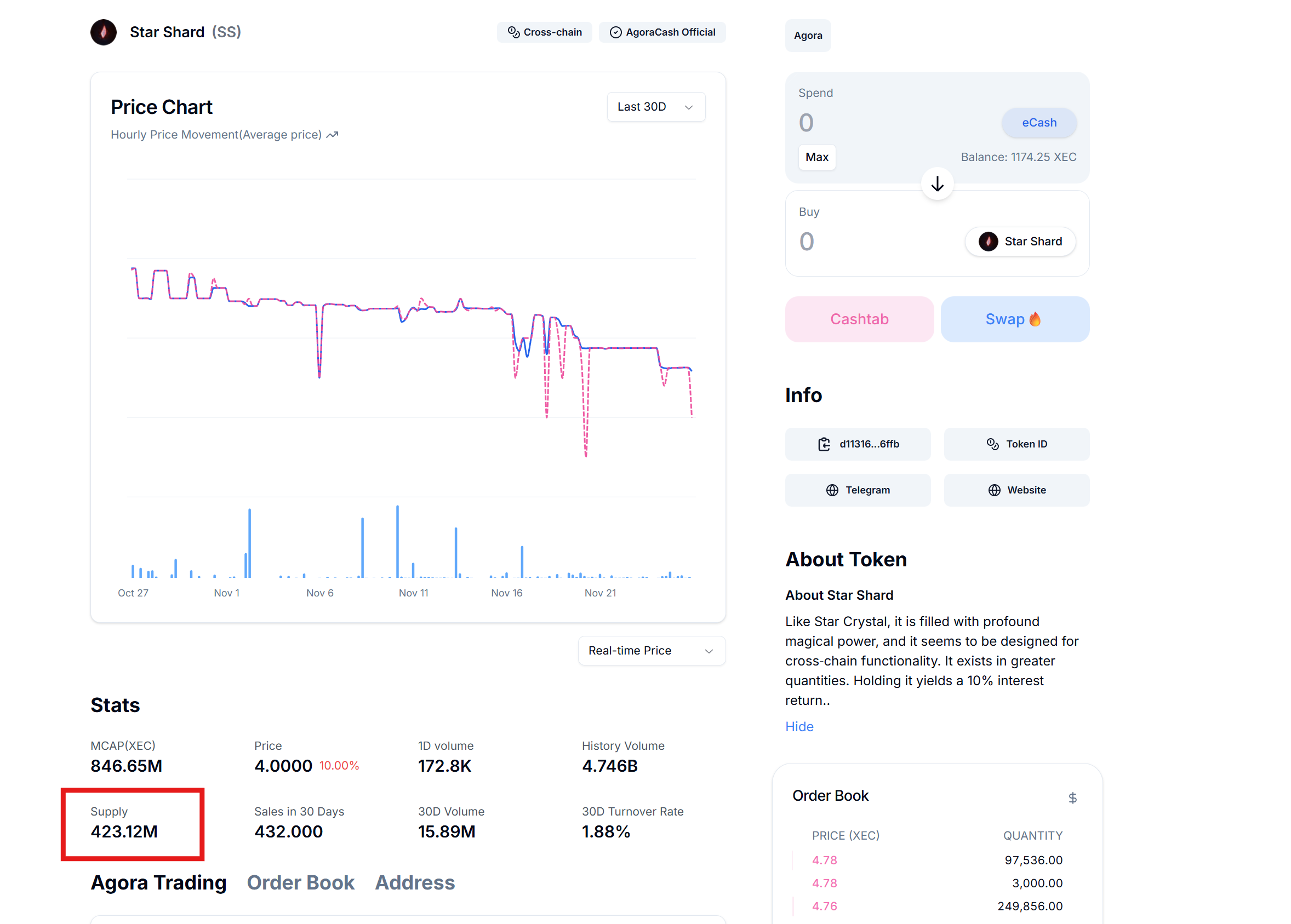

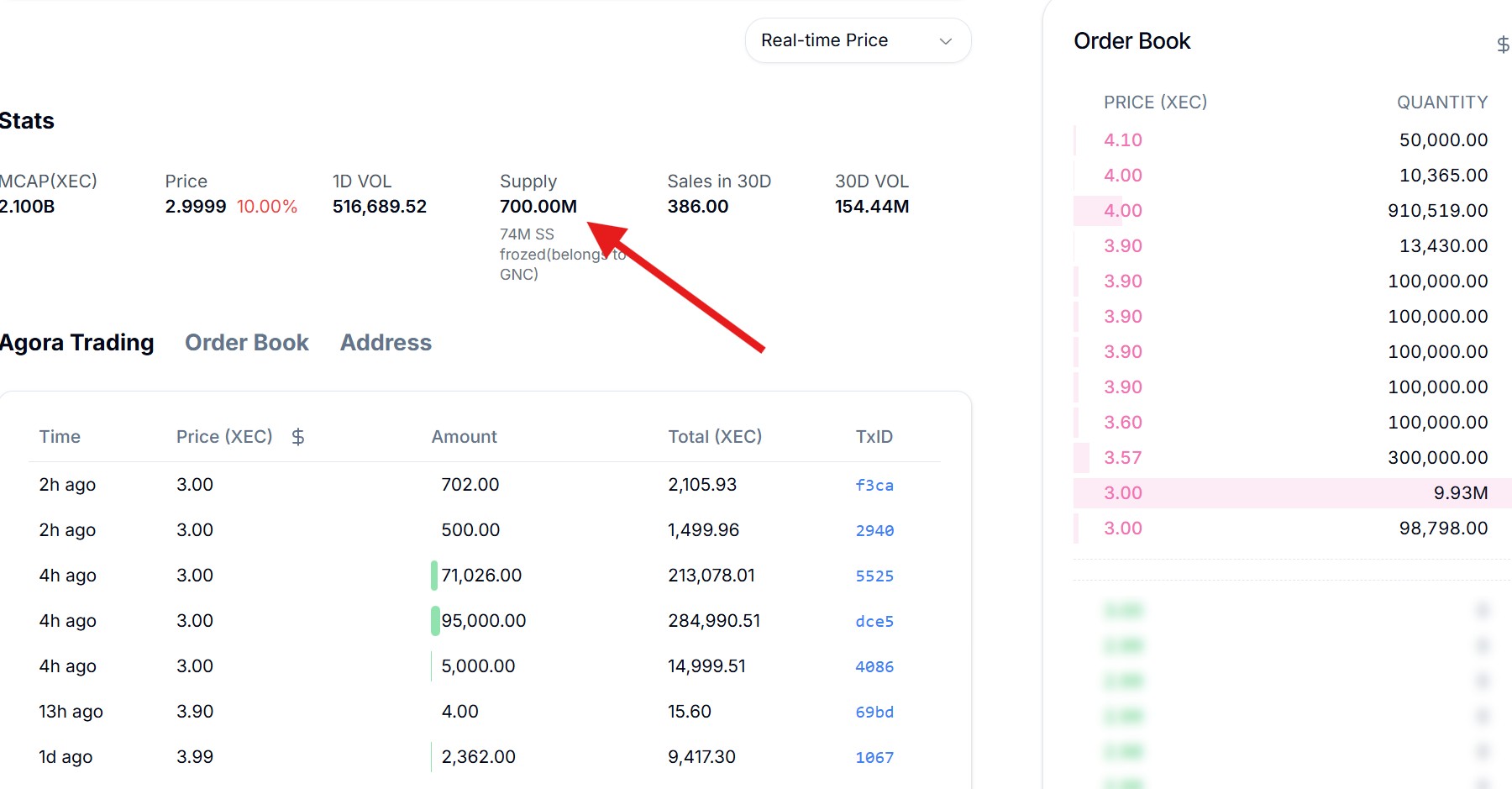

SS was promised to have a supply of 300 million tokens, which is still shown in their current description (see image above).

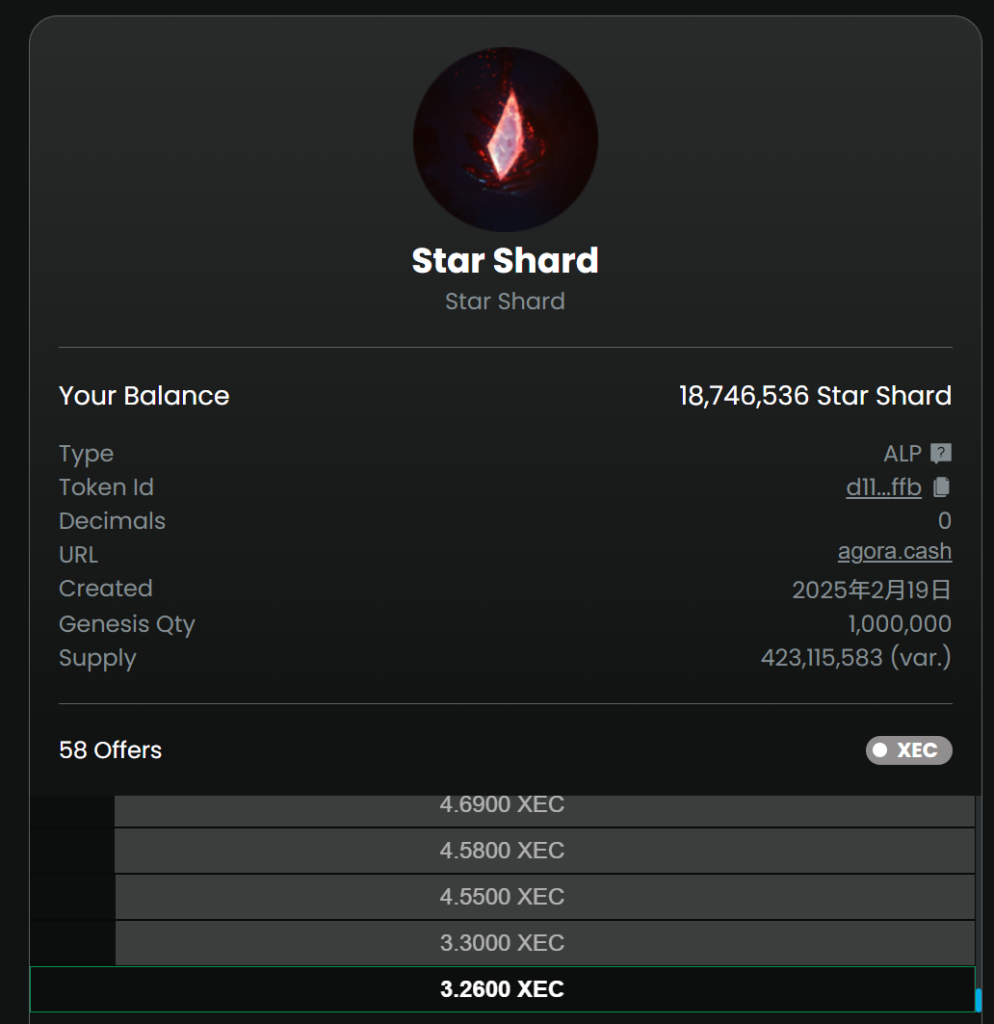

However, they have secretly minted over 123 million additional tokens. The current total supply of SS is 423,115,583 (see image below).

You can verify this on cashtab.com. This means that SS has been inflated by 41% without any warning, severely damaging the interests of holders.

As shown in the image, I originally held 6% of the total supply, which has now dropped directly to 4.2% after the inflation.

In reality, SS has been confirmed to be a fraudulent token (scam coin) that violates its promises, has an effectively unlimited supply, and is now worthless.

3. Market Censorship/Manipulation

On the agora.cash homepage, orders for Star Shard (SS) below 4 XEC are not displayed, and orders below 2 XEC are not even included in the statistics.

4. Hiding Evidence

Currently, agora.cash has deleted its X account (Twitter) to conceal its past statements.

Two of the four tokens issued by agora.cash have already defaulted. Regarding PromoX and SPARK, I strongly advise everyone to exercise caution.

There is no team behind agora.cash; it is simply one person controlling everything, engaging in unchecked and malicious deception.

Agora.cash previously claimed that the eCash GNC sponsored this project. If true, the GNC has an obligation to respond to these claims/allegations.

Statement on eCash

I remain very optimistic about the eCash project. I built websites utilizing PayButton, issued NFTs and the eCash’s Hatching Day commemorative coin, and enjoyed playing games… All of that has been great.

Of course, I also heavily invested (held a large position) in the exchange’s platform token to support its development. But what did I get in return? Lies, deceit, malicious token inflation…

The eCash project, having already achieved Avalanche Pre-consensus, is destined for a bright future. As we encourage the good things, we must also purge the bad ones.

I will update this post with developments and the official response from eCash (if any). This update’s time is 2025-11-26 10:33:09 (UTC-8).

Call to Action

If you are also a victim of agora.cash or an attorney with experience in cryptocurrency fraud cases, please contact me on my X account: @logospunk

2025-11-26 12:37:10 (UTC-8). Supplement:

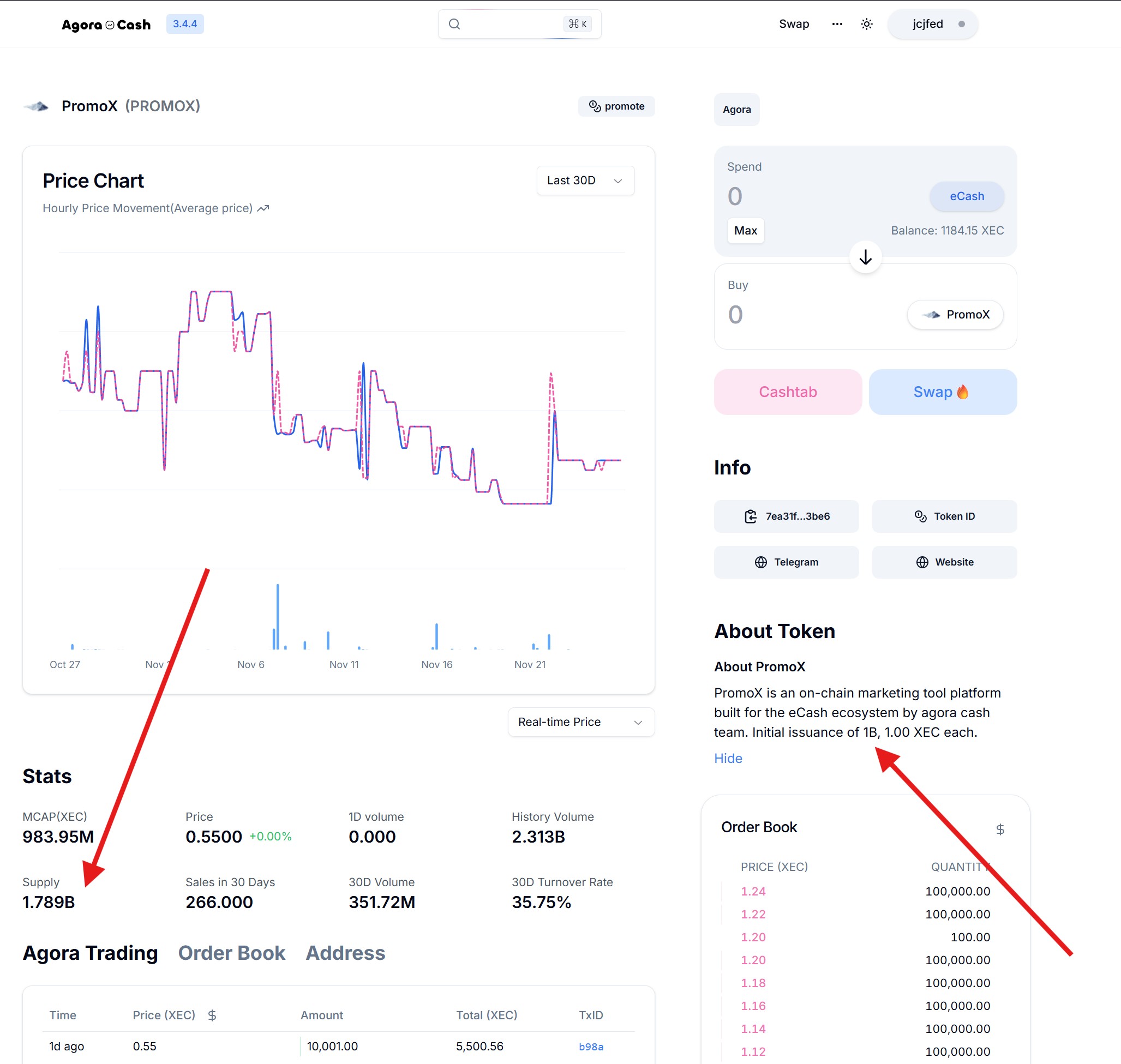

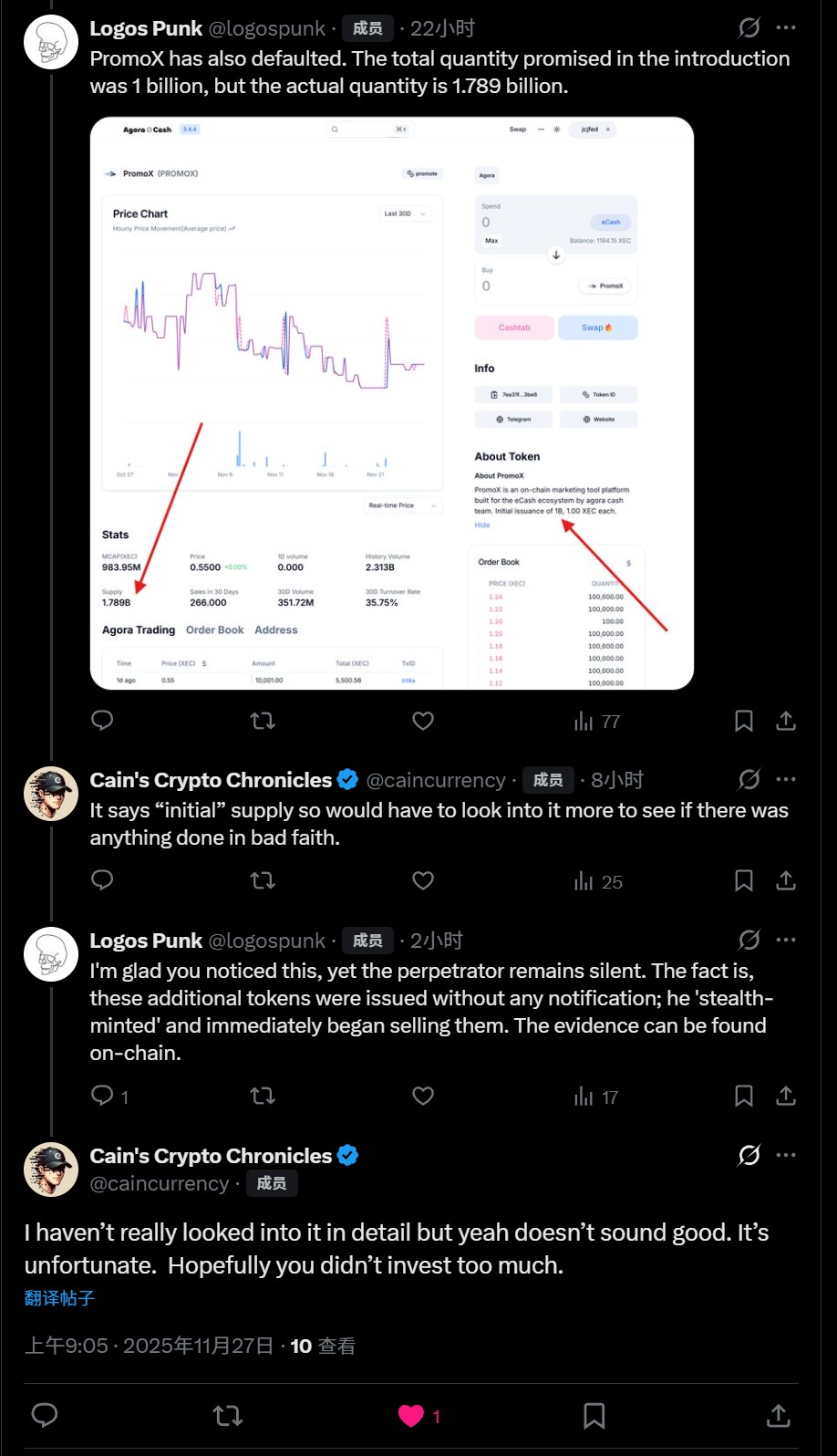

PromoX has also defaulted. The total quantity promised in the introduction was 1 billion, but the actual quantity is 1.789 billion.

This means that three of the four tokens issued by agora.cash have now defaulted.

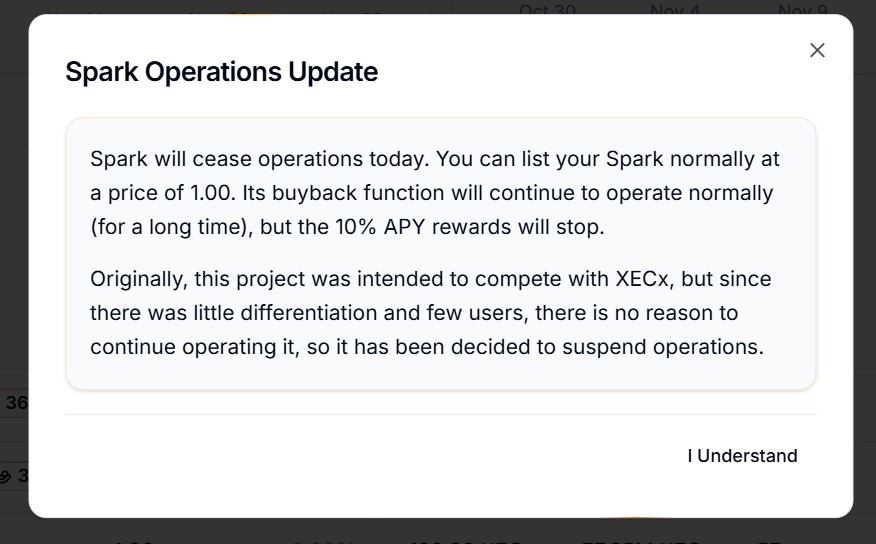

2025-11-26 12:53:32 (UTC-8) Update: Spark announced the cessation of its operations. This marks the discontinuation of agora.cash‘s only non-defaulted project, bringing agora.cash’s token default rate to 100%.

2025-11-27 11:33:13 (UTC-8) Update:

A day has passed, and neither agora.cash nor eCash has responded to this matter. However, I am pleased to see the comment from caincurrency, who is an eCash community KOL and the author of ProofOfWriting.com.

I made a poster; modern AI tools are really great to work with.

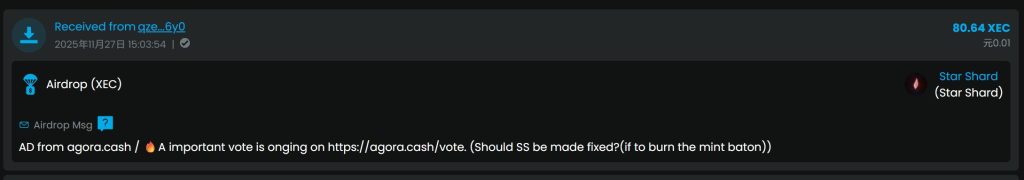

2025-11-27 16:13:07(UTC-8) Update:

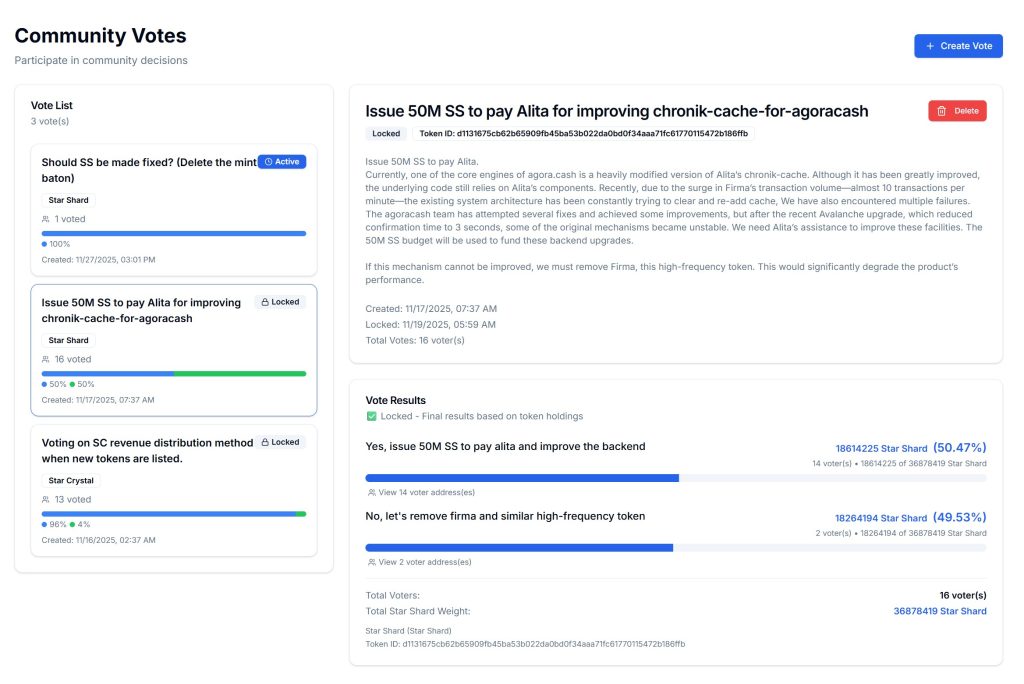

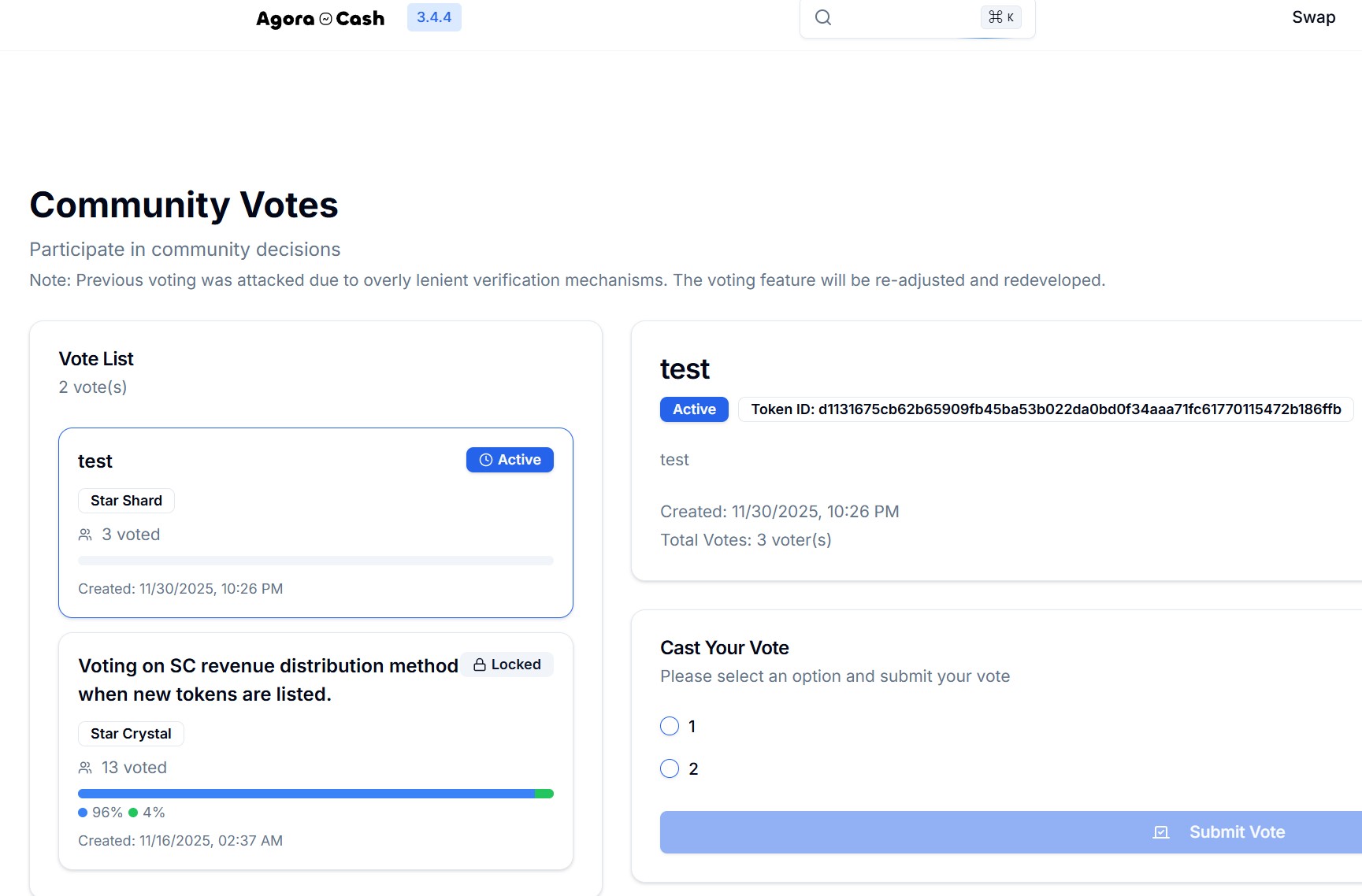

agora.cash is making up new lies! The over-issuance of SS was never subjected to a vote.

There was a previous vote,

However, the over-issuance had actually already been completed and the coins/tokens were directly put up for sale before that vote. These actions can all be verified on the eCash blockchain.

Furthermore, the number of over-issued SS was more than just 50M.

This kind of vote is meaningless because the owner of agora.cash controls the vast majority of the capital/tokens, allowing them to achieve any result they desire.

Additionally, agora.cash requires you to enter your wallet’s mnemonic phrase. Given the questionable credibility of agora.cash, I consider this to be dangerous. If your wallet has previously granted authorization to agora.cash, you should immediately transfer all your assets out and stop using that wallet.

As of this update, still no one has responded to the default issue of agora.cash. Why? Because everything I’ve stated is fact—thanks to the blockchain, all actions are recorded and immutable—if they were to respond, they only have two options: admit it or continue fabricating new lies.

On the X platform, I was kicked out of the community by a moderator of the eCash community. This is the current state of the XEC community: they don’t solve the problem, they solve the person who raised the problem.

I want to tell you all:

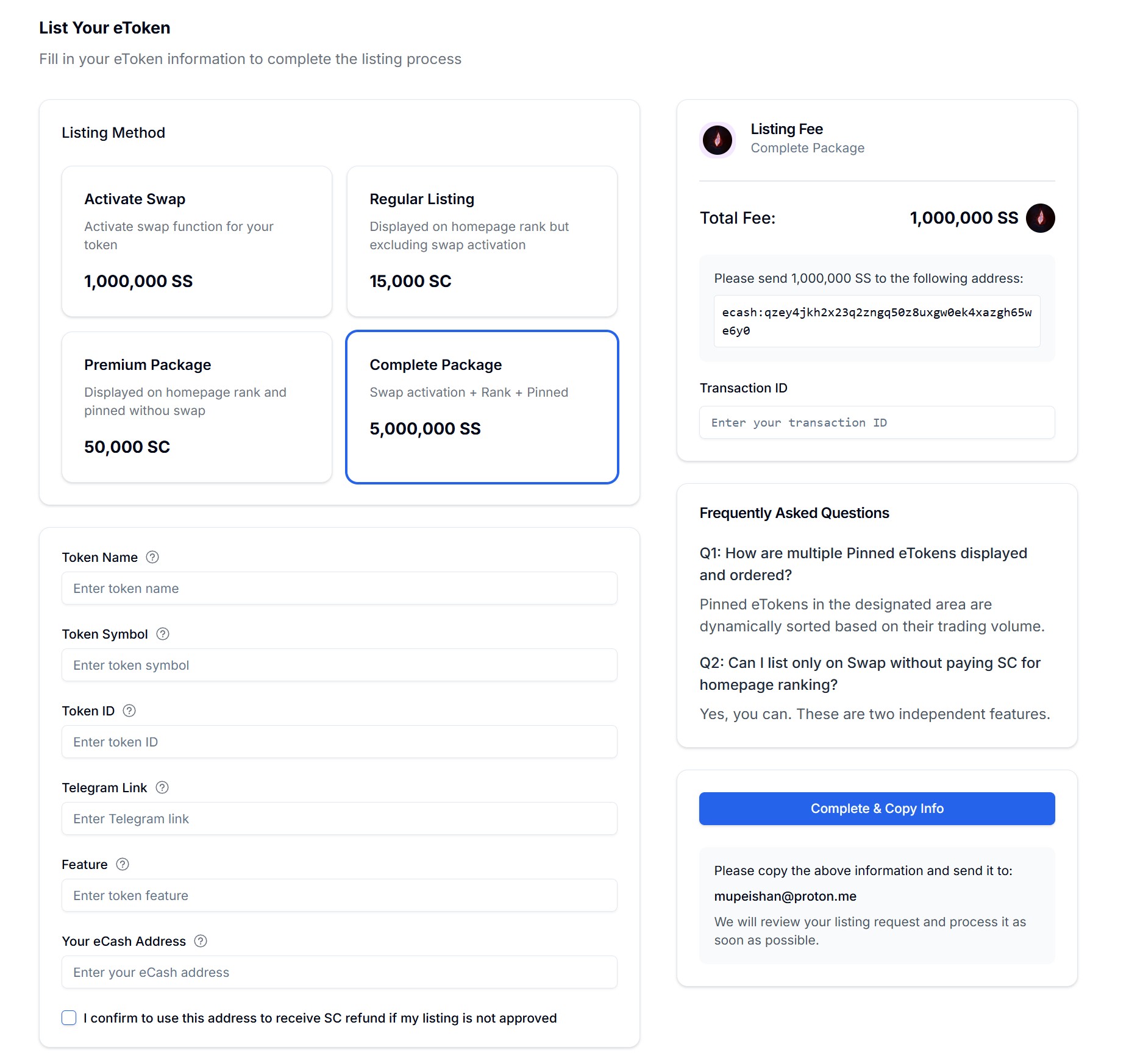

agora.cash is fundamentally not an exchange. The core trading function is on Cashtab; agora.cash merely created a display list. Not a single piece of the technology they promised has been implemented. We were all deceived. In reality, agora.cash’s only value was the entry point Cashtab gave it.

But, why did Cashtab give it an entry point?

I bought the agora.cash tokens and lost XEC. I deserved the loss because I was naive enough to trust this group of scammers; this loss is my punishment. I accept all of this.

Now that it has been clearly established that agora.cash is a scam, the eCash official team should take action to prevent more people from being victimized.

Cashtab should remove the link to agora.cash.

agora.cash should have to independently and autonomously acquire users. Only then will they learn to respect customers and maintain integrity.

Why is eCash, which boasts ultra-high performance, experiencing a prolonged price slump? Because it lacks self-purification capability and tolerates scams like agora.cash—a tumor allowed to operate unchecked. It’s like a strong, healthy man who has a huge, disgusting tumor but refuses to have surgery.

Today I discovered that agora.cash has started fabricating a new lie: because the voting results were not what they wanted, they directly deleted the poll and blamed it on a hacker attack.

2025-12-05 15:05:34(UTC-8) Update:

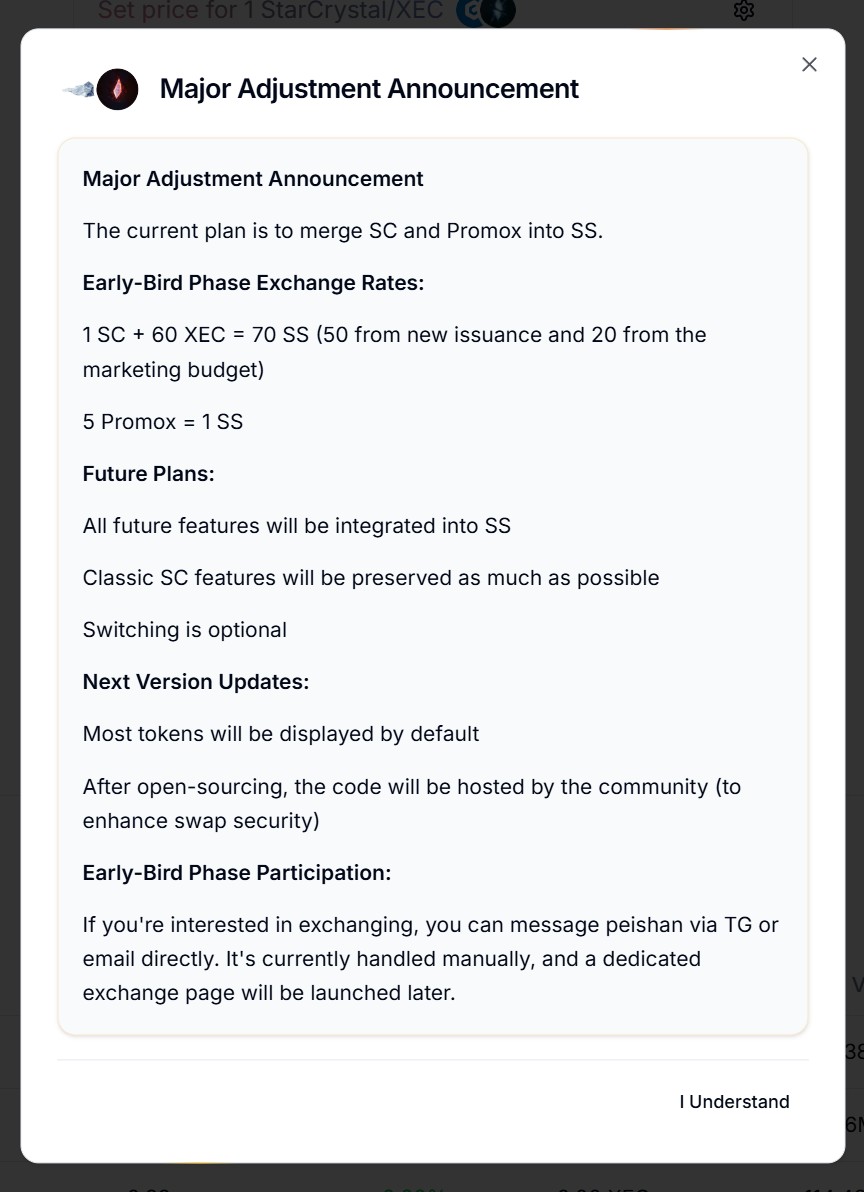

⚠️ The equity of SC holders have been abandoned. Agora.cash is replacing SC with an infinitely inflationary token (SS). Holders, you have been tricked again.

2025-12-10 09:25:07(UTC-8) Update:

Attention! The default scam by agora.cash is continuing. They are going to replace the fixed amount of SC with an infinitely inflating SS.

2025-12-12 10:50:20(UTC-8) Update:

The default behavior by agora.cash continues. Now, agora.cash is forcing users to convert their fixed-supply SC (Siacoin) holdings into the infinitely-mintable SS token.

This specifically means that the SS supply is about to be inflated by 200%, rising from 300 million to 900 million tokens.

The breakdown of this required inflation is as follows:

- SC Conversion Requirement: The total supply of SC is 5,120,000 tokens. Based on the forced exchange rate of 1 SC + 60 XEC = 70 SS, a minimum of 358,400,000 SS is required. (You read that correctly: you are also forced to pay 60 XEC per SC for this mandatory exchange.)

- PromoX Conversion Requirement: The total supply of PromoX is 1 Billion (1B). Based on the exchange rate of 5 PromoX= 1 SS, 0.2 Billion (200M) SS is needed.

The current total supply of SS is 374 M, which is insufficient to support these conversions. Therefore, agora.cash is compelled to mint new SS tokens.

This means that agora.cash will need to mint at least an additional 558M SS, which, when added to the previously minted 74M, will push the total SS supply over 932 M. In the span of just one year, the SS supply will have skyrocketed from 300 M to over 900 M!

How many people, like me, bought and held SS because they were attracted by the 10% Annual Percentage Yield (APY)? Now, we may be receiving the 10% APY, but the SS supply has simultaneously inflated by a factor of three.

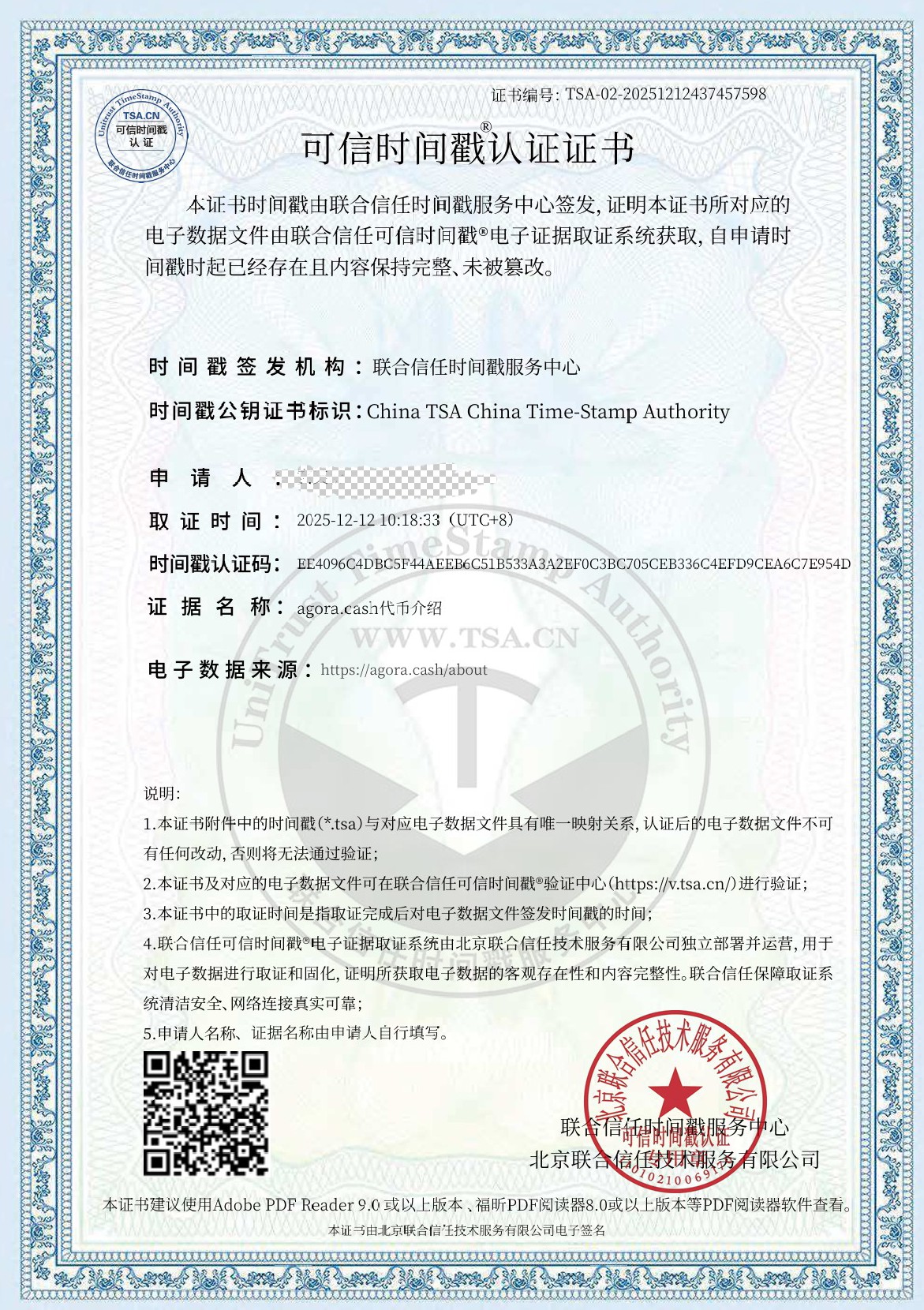

I have already collected and officially notarized evidence of agora.cash’s breach of contract in China. If you cannot read Chinese, it is irrelevant; the image below is one piece of court-admissible blockchain evidence (proof of deposit). The operators of agora.cash should be fortunate—and may be hoping—that the price of XEC remains low. If the price were to rise, for example, to the level of Bitcoin, I believe lawyers would certainly take a strong interest in this case.

2025-12-26 11:53:44(UTC-8) Update:

The facts are clear: Agora.cash deactivated their X account even before the default occurred. When I exposed their scam, idiots like @NateNovosel and @eChan_XEC actually came forward to defend them. It’s pathetic how XEC has become such a “scammer-friendly” ecosystem.

Nate, in particular, is beyond foolish. This moron has been desperately trying to play the leader of the XEC community, but he is destined to fail. Why? Because he is simply too dim-witted. Everyone will remember that when the Agora.cash scam unfolded, he chose to stand as a shield for the fraudsters.

My Response to His Allegations:

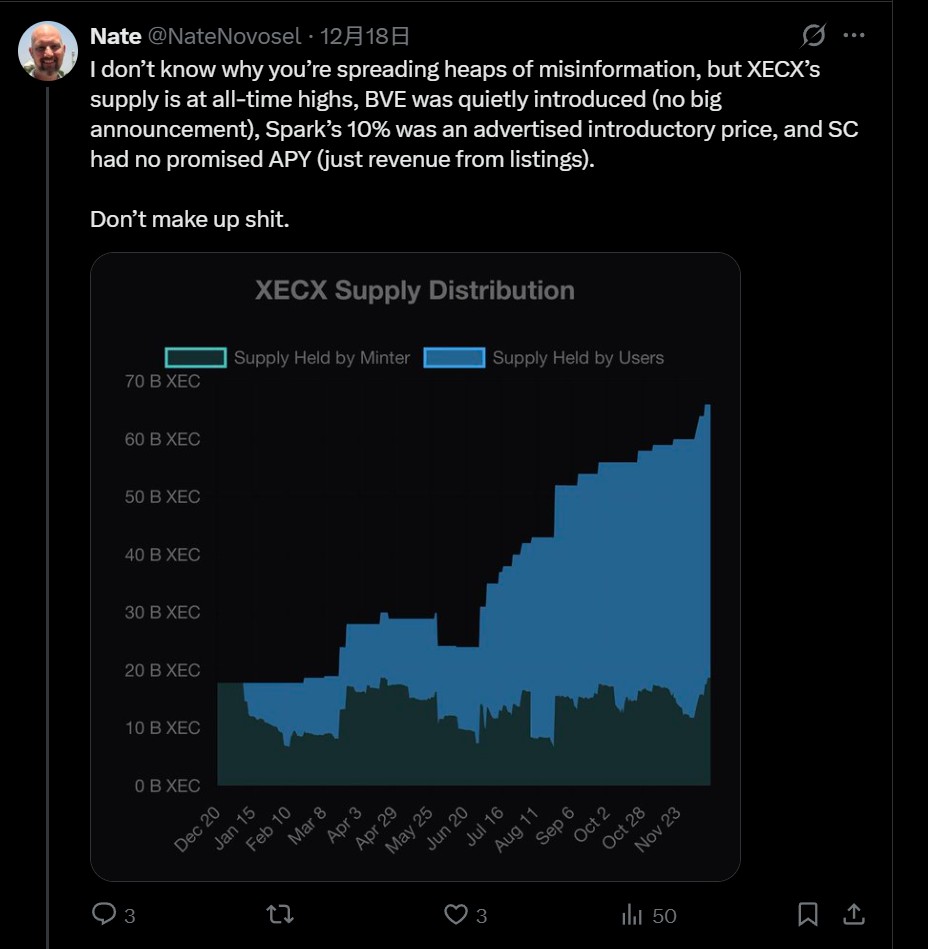

1. On the timing and data: This information was posted on December 17, 2025. Just look at the redemption volume for XECX. That massive red spike shows that between December 14th and 15th, over 1.3 billion XEC were redeemed. This is a clear “flight to safety” by the community, reacting to the risks within the XEC ecosystem projects.

2. On BVE’s marketing: Claiming BVE’s promotion was “low-key” is a blatant lie. I’ve seen BVE advertisements plastered all over X. His claim is completely inconsistent with the facts.

3. On Spark’s pricing: He claims, “Spark’s 10% was an advertised introductory price.” What is that even supposed to mean? Is he suggesting that because it was a “promotion,” they are no longer obligated to honor it? A commitment is a commitment, not a disposable marketing gimmick.

4. On the SC yield promises: The statement “SC had no promised APY (just revenue from listings)” is a bold-faced lie. SC absolutely promised an APY, which was then terminated abruptly without any prior notice. This is a textbook case of default and fraud. It also proves that an idiot like Nate is utterly incapable of standing behind his own words.

Furthermore, the total supply of SS has exploded from the promised 300 million to 700 million in less than a year. Even when factoring in the 10% APY, holders like me have suffered a net loss of at least 50% in value!

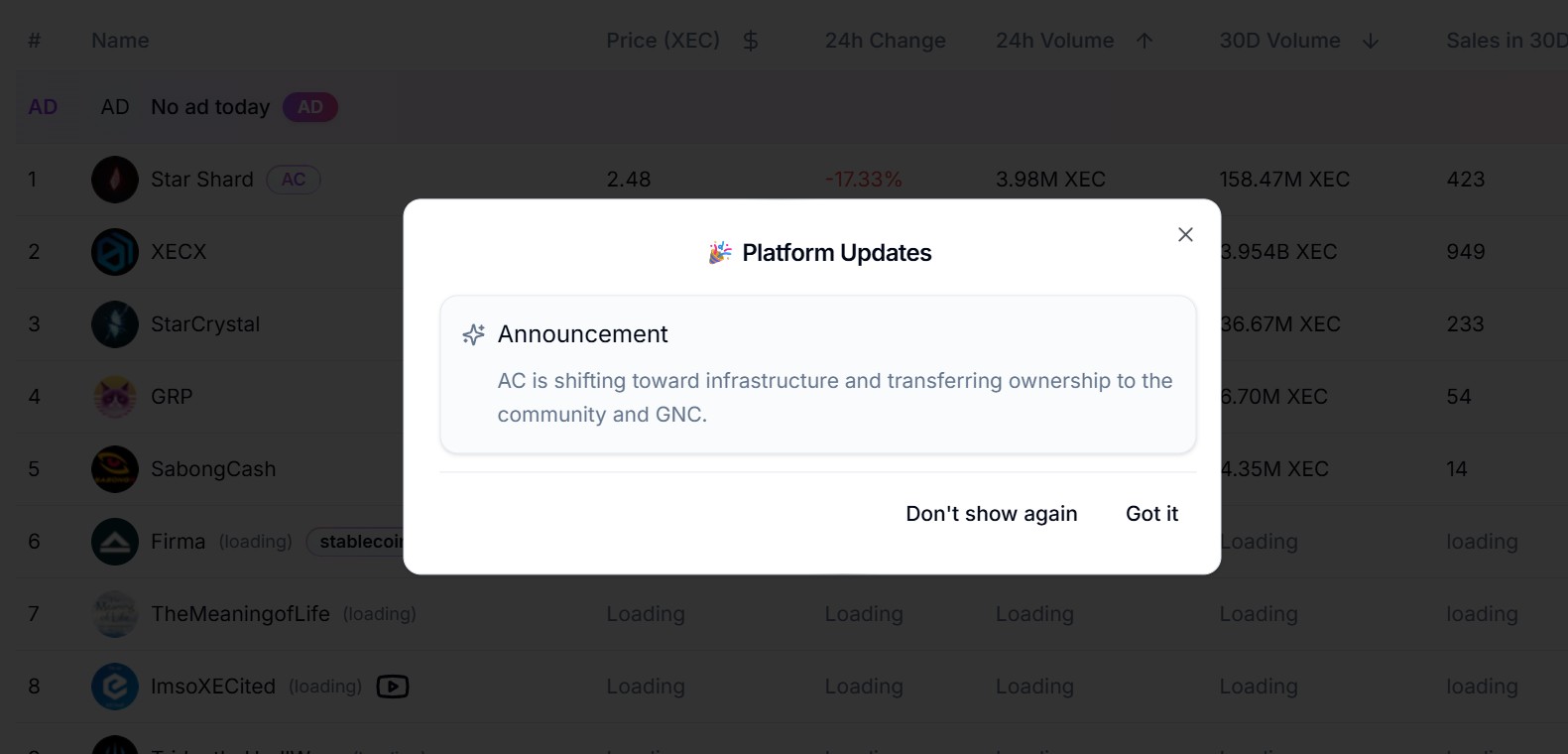

Agora.cash’s latest announcement makes it clear: they are preparing to pull the rug. Listen carefully: I have notarized every single one of your defaults. Right now, the price of $XEC is too low for lawyers to take interest, but the day $XEC skyrockets will be your doomsday.

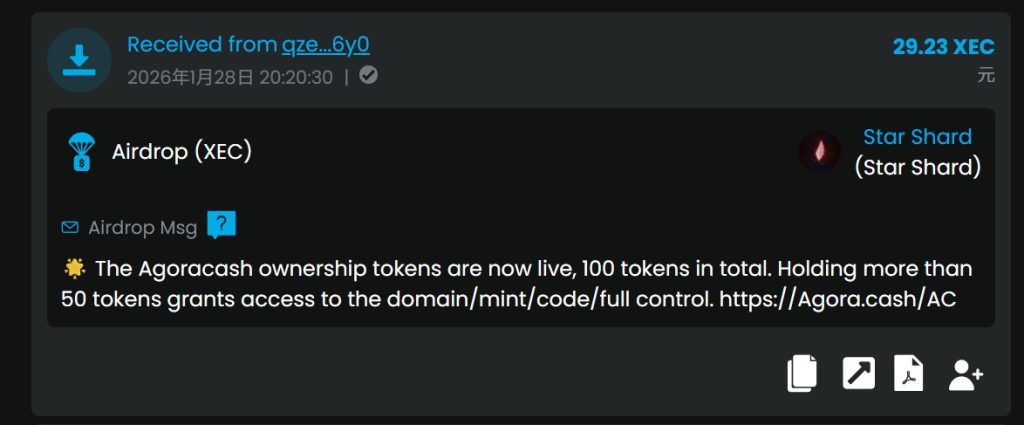

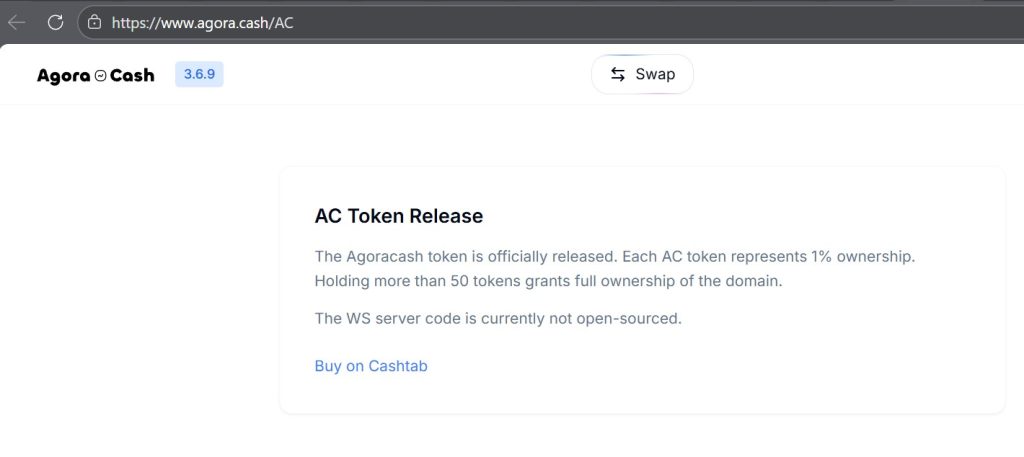

2026-01-28 20:58:37 (UTC-8) Update:

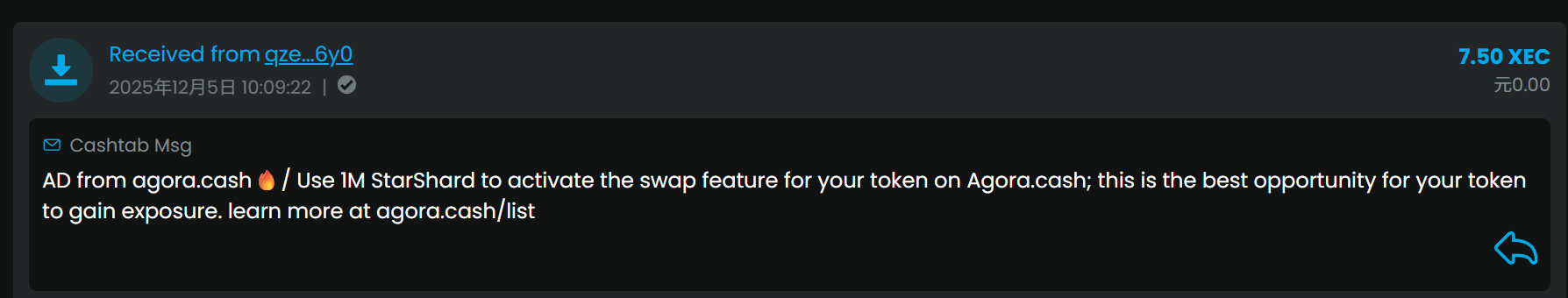

Just received this message on Cashtab:

Agora.cash has verified

This marks the official rug pull of Agora.cash, and it’s a desperate attempt at one last exit scam.

I want to warn everyone: this is a pure scam. If you buy “AC ownership tokens,” you are not buying an asset—you are legally obligating yourself to its outstanding debts and legal liabilities.